A Further Look | Mar 31, 2025

There Are Always Things to Worry About, but Market Volatility Shouldn’t (Always) Be One of Them

David B. Root, Jr.CFP®

CFP®

“Far more money has been lost by investors trying to anticipate corrections, than lost in the corrections themselves.” – Peter Lynch

If history has taught us anything, it is that market downturns aren’t anomalies, they are part of the game. In 1994, the year I started my business, legendary investor Peter Lynch profoundly stated to a National Press Club audience; “The key organ in your body in the stock market is the stomach, not the brain.” He was talking about the importance of discipline during times of market volatility. Investors lose money not because they lack skills or knowledge, but because they can't stomach market volatility.

Fast forward to 2025, when we once again find ourselves in the midst of a period of elevated volatility. After two straight years of nearly uninterrupted gains, the recent period from late-February to early-March – during which the S&P 500 was down about 10% peak to trough – might have felt excruciating. But consider this: as long-term investors, how much do short bouts of volatility like this impact our ability to achieve long-term objectives? After all, if you zoom out from the immediate term to the full year, the S&P 500 is down just -3.2% year-to-date.1 Although losses of any magnitude can be unsettling, such periodic declines throughout the year are normal. In fact, larger intra-year pullbacks exceeding -10% are quite common. Since 1980, the S&P 500 has suffered an average intra-year pullback of -14%, with 16 of 44 years seeing even steeper intra-year losses.2

However, over the same period, the markets have tended to reward those who remained invested. Since 1980, the S&P 500 has delivered positive annual returns in 34 of the last 44 years, emphasizing a clear upward long-term trajectory.2 Over this full 44-year period, the average annualized return for the S&P 500 has exceeded 10%.2 So, while the risk of owning stocks is short-term volatility, the reward has historically come in for form of long-term capital appreciation.

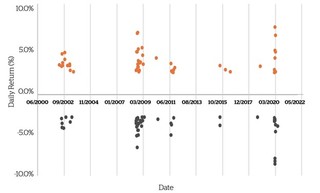

The two Peter Lynch quotes cited earlier in this note pair together nicely during periods of elevated volatility. One relates to resolve in the face of risk, and the other speaks to a natural desire to attempt to time these risks. When volatility rises, a common behavioral refrain is to get out of the market to avoid additional or prospective losses. While it is natural to want to avoid the discomfort associated with potential loss, this can be viewed as an exercise in market timing. It’s often easier to do this in a (partially) correct fashion when markets are in a persistent decline, as they have been recently. When to re-enter the market, however, is much more difficult. How can one possibly time both sides of the trade perfectly, to avoid the full extent of losses and capture the full extent of the rebound when it comes? The answer, of course, is investors probably will not execute this perfectly. This is why we so often stress the importance of ‘time in the market’ versus ‘timing the market.’ The below chart nicely illustrates both the pitfalls of trying to time the market and the benefits of remaining invested in volatile times.3

To further illustrate the difficulty of timing both the exit and the re-entry, and the value of remaining invested throughout, consider the below chart.4 This shows that the worst days for the MSCI World Total Return Index are often followed in short succession by the best days. So, while an investor might get the exit portion of the trade (again, partially) right, it is unlikely that they will move quickly enough to reverse their sentiment and participate in the best days. This is how – even if you sell at a reasonably correct time – missing the best days can lead to such a dramatic lag in long-term returns.

Furthermore, times like this reinforce the power and benefits of diversification. Spreading your investments across various asset classes and geographies can help balance overall risk. For instance, bonds have provided positive diversification relative to equities in all but 5 years since 1928. This year, bonds are up a bit while US equities are down just over 3%. In 2025, we have also seen international equities up around 10%.5 During phenomenal years for domestic equity markets, diversification can seem like a drag on returns. This has certainly been the case over the past few years, as both bonds and international equities meaningfully lagged US equities. However, during times like the present, it pays to be diversified. And regular rebalancing ensures that your portfolio stays aligned with your investment goals and risk tolerance.

Lastly, don’t forget that we came into the year in a very good place. Two consecutive strong years for the markets and an economy that was on good footing fundamentally. Add solid GDP growth, progress on lowering inflation and a rate cutting cycle in progress, and there were plenty of reasons to be optimistic. While things have been choppy and could remain so for a little while, it’s important to stay focused on the long-term. It will help to avoid one of the most common pitfalls investors face, which is letting our emotions impact and possibly derail the progress we have made with our long-term plan.

As I write this, the stock market continues to wobble between positive and negative days. But if we avoid diverging from our long-term strategic asset allocations, we can also avoid unnecessary losses and further stress. Experienced investors often look at selloffs as a buying opportunity. US large-cap stocks for example have recently been on sale at a 5% discount relative to fair market value.6 Even holders of 401(k)s may unconsciously be taking advantage via dollar-cost averaging of their scheduled contributions. They might also be benefitting from diversification through the use of target date funds.

We have no way of predicting the future. It’s hard to say whether the current pull back will be short-lived or longer-lasting. But if we continue to hold our emotions at bay, today’s volatility may represent an opportunity for investors long-term.

We’re going to be OK.

Thanks for reading.

1 Factset

2 JP Morgan Asset Management, Guide to the Markets 4Q2024

3Hartford Funds, Morningstar, Ned Davis Research. As of January 1, 2025

4Bloomberg, MSCI World Total Return Index. Dates: 1/3/2022 to 9/3/2022

5 Factset

6 Morningstar, US Fair Market Value https://www.morningstar.com/markets/fair-value?market=large-cap

This material has been provided for general, informational purposes only, represents only a summary of the topics discussed, and is not suitable for everyone. The information contained herein should not be construed as personalized investment advice or recommendations. Rather, they simply reflect the opinions and views of the author. D. B. Root & Company, LLC. does not provide legal, tax, or accounting advice. Before making decisions with legal, tax, or accounting ramifications, you should consult appropriate professionals for advice that is specific to your situation. There can be no assurance that any particular strategy or investment will prove profitable. This document contains information derived from third party sources. Although we believe these third-party sources to be reliable, we make no representations as to the accuracy or completeness of any information derived from such sources, and take no responsibility therefore. This document contains certain forward-looking statements signaled by words such as "anticipate," "expect", or "believe" that indicate future possibilities. Due to known and unknown risks, other uncertainties and factors, actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that the expectations, beliefs, views and opinions expressed in this document will come to pass. Information presented herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. All investment strategies have the potential for profit or loss. Asset allocation and diversification do not ensure or guarantee better performance and cannot eliminate the risk of investment losses.

David B. Root, Jr.

CFP®